Medicare does not typically cover Viagra or similar medications for erectile dysfunction. Instead, these drugs are generally classified as “excluded” from coverage under Medicare Part D plans. However, some beneficiaries might find alternative ways to obtain assistance, such as manufacturer discounts or using specific assistance programs.

For individuals with certain medical conditions, Medicare may cover erectile dysfunction treatments if they are prescribed as part of therapy for other health concerns. It is advisable to consult with your healthcare provider to discuss your unique situation and explore potential coverage options available through your Medicare plan. Understanding your medication coverage can help you make informed decisions regarding your healthcare expenses.

Beyond Medicare, many private insurance plans provide some level of coverage for erectile dysfunction medications, often with limitations. Conducting a review of your specific plan’s formulary and benefit structure can clarify what costs you might expect. Seek advice from your insurance representative or your pharmacist for specific details regarding coverage and potential alternatives.

- Is Viagra Covered on Medicare?

- Understanding Medicare Coverage of Prescription Drugs

- Eligibility Criteria for Viagra Coverage Under Medicare

- Specific Conditions for Coverage

- Supplementing with Private Insurance

- How to Get Viagra Prescribed Through Your Doctor

- Potential Costs: What You Might Pay for Viagra on Medicare

- Understanding Medicare Part D Coverage

- Potential Costs

- Alternatives to Viagra Covered by Medicare

Is Viagra Covered on Medicare?

Medicare generally does not cover Viagra or other erectile dysfunction medications. These drugs fall under Part D, which covers prescription medications but typically excludes treatments for sexual dysfunction.

If you have Medicare Advantage (Part C), coverage for Viagra may vary by plan. Some Medicare Advantage plans may offer limited coverage for these drugs, but it’s crucial to check with your specific provider for details.

Patients interested in obtaining these medications may consider discussing alternative options with their healthcare provider. Generic versions of erectile dysfunction medications might be more affordable and could be covered under certain Part D plans.

Additionally, some patients find it beneficial to explore programs offered by pharmaceutical companies that provide discounts or patient assistance. This could help offset costs if you do not have coverage through Medicare.

For personalized assistance, always consult your Medicare plan documents or reach out to a Medicare representative to get the most accurate and updated information regarding coverage and options available to you.

Understanding Medicare Coverage of Prescription Drugs

Medicare typically does not cover all prescription drugs. Most prescription medications fall under Part D, which is a Medicare prescription drug plan. To receive this coverage, beneficiaries must enroll in a standalone Part D plan or a Medicare Advantage plan that includes drug coverage.

The list of covered medications, known as the formulary, varies by plan. Each plan includes a specific group of drugs at different cost tiers. Beneficiaries should review the formulary to verify that their necessary medications are covered and to determine their out-of-pocket costs.

Some medications, like erectile dysfunction drugs, may face limitations or exclusions. While Viagra is not generally covered by Medicare, some plans might consider it under certain medical circumstances, such as a diagnosis of erectile dysfunction related to prostate cancer treatment.

Beneficiaries should consult their plan’s specifics to identify if any prior authorization is required for coverage of specific drugs. It’s also beneficial to compare different Part D plans annually during the open enrollment period, as coverage options can change.

In summary, staying informed about the details of Medicare prescription drug coverage will help ensure access to necessary medications while managing costs effectively.

Eligibility Criteria for Viagra Coverage Under Medicare

Medicare does not generally cover Viagra and other erectile dysfunction medications under Part A or Part B. However, in certain cases, coverage may be available through Medicare Part D if prescribed for a specific medical condition. To qualify, your doctor must diagnose you with a condition that requires this medication.

Specific Conditions for Coverage

Coverage may be granted if the medication is deemed medically necessary for conditions such as:

- Severe erectile dysfunction resulting from a medical issue

- Certain hormone deficiencies

- Post-surgical effects on erectile function

Ensure that your healthcare provider documents the medical necessity clearly in your records. This documentation will be crucial for any claim filed for coverage through your Part D plan.

Supplementing with Private Insurance

If Medicare does not cover your prescription, many beneficiaries opt for private insurance plans. Some of these may include coverage for erectile dysfunction medications. Always check your specific policy details to understand your options.

| Criteria | Explanation |

|---|---|

| Doctor’s Prescription | A valid prescription from a licensed healthcare provider is necessary. |

| Medical Diagnosis | Diagnosis should indicate a compelling need for erectile dysfunction treatment. |

| Documentation | Proper documentation of the condition must be available for approval. |

| Part D Plan Usage | Check if your Part D plan includes coverage for prescribed medications. |

How to Get Viagra Prescribed Through Your Doctor

Prepare for your appointment by gathering relevant medical history, including any current medications and underlying health conditions. This information helps your doctor assess your situation accurately.

Be open and honest when discussing your symptoms with your doctor. Describe any issues you experience related to erectile dysfunction, mentioning how long you’ve been facing these challenges and any factors that may contribute to the condition.

Ask direct questions about Viagra and its suitability for your case. Demonstrating that you’ve done your research can indicate your seriousness about seeking help. Discuss potential side effects and interactions with other medications you may be taking.

If your doctor believes that Viagra is a suitable option, they will likely perform some tests to rule out other health issues. This may include checking hormone levels, blood pressure, and evaluating cardiovascular health.

Once prescribed, follow dosage instructions carefully. Discuss any side effects with your doctor during follow-up appointments to ensure the treatment remains effective and safe.

If coverage under Medicare is a concern, inquire about which plans include Viagra as part of their benefits. This will help you manage costs effectively. Your doctor may also have resources or advice for navigating these insurance details.

Maintaining an open line of communication with your healthcare provider is key. Regular discussions about your experience with the medication will help optimize your treatment plan and address any concerns that arise.

Potential Costs: What You Might Pay for Viagra on Medicare

Under Medicare, Viagra is not typically covered as a part of the standard prescription drug benefit. However, if you have Medicare Advantage or a separate Part D plan, you might have some coverage for erectile dysfunction medications, including Viagra.

Understanding Medicare Part D Coverage

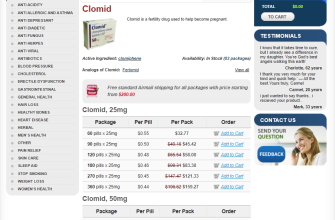

Medicare Part D plans vary significantly in their formulary, which lists covered drugs. Some plans include Viagra, while others do not. If your Part D plan covers it, you will likely need to pay a portion of the cost, which could range from a copayment to a percentage of the drug’s price. Always check your specific plan to understand your out-of-pocket costs.

Potential Costs

If Medicare covers your Viagra prescription, expect to pay a copayment, which may range from $10 to $50 per prescription, depending on your plan. If the medication is not covered, you will have to pay the entire cost, which can be around $70 to $90 for a single pill without insurance. Look into generic options like sildenafil, which can be more affordable. Always consult your pharmacist or healthcare provider for the best options available within your Medicare plan.

Alternatives to Viagra Covered by Medicare

Medicare offers coverage for several alternatives to Viagra for individuals experiencing erectile dysfunction. Here are the main options you might consider:

- Cialis (Tadalafil): This medication is often prescribed for erectile dysfunction and has a long duration of action, typically up to 36 hours. Medicare may cover this if deemed medically necessary.

- Levitra (Vardenafil): Another oral medication that works similarly to Viagra, Levitra can enhance blood flow to the penis. Coverage through Medicare is possible if prescribed by a healthcare provider.

- Stendra (Avanafil): This newer option works quickly and may be a good choice for those who want a more spontaneous approach. Availability under Medicare depends on prescription needs.

Beyond oral medications, consider the following therapies:

- Pump Therapy: Vacuum erection devices are safe and effective. Medicare typically provides coverage for these devices with a proper prescription.

- Injectable Therapies: Medications such as Alprostadil can be injected directly into the penis. Coverage is available, but consultation with your healthcare provider is crucial.

- Intraurethral Therapy: Using an Alprostadil suppository inserted into the urethra is another option. Medicare may cover this treatment based on medical necessity.

Always consult your healthcare provider to discuss these options and see what is best suited for your condition. They can guide you through the process and help you understand your Medicare benefits.